Online SBI Account Opening in Zero Balance : millions of customers, the state bank of India (SBI bank) is one of India’s largest banks. Account opening is one of many services provided by the bank. Over the past year, the SBI bank has developed and implemented new banking concepts that are suitable for all bankers. Customers can now conduct business from anywhere in India without having to visit the bank. For the majority of SBI customers, the new banking trend is the online banking system.

The bank has introduced SBI accounts, which do not require a minimum balance to operate, as one of its online innovations. A SBI account with no balance is available to the customer. a brand-new feature from SBI Bank that lets users keep an account open without having to have a minimum balance.

Online SBI Account Opening in Zero Balance

With the State Bank of India (SBI) mobile app, users can open a savings account with no balance. On the microblogging platform Twitter, the nation’s largest public sector bank stated this. Online SBI Account Opening in Zero Balance says that until August 31, 2018, users can use the mobile app YONO to open a new savings bank account with no minimum balance as part of a limited-time offer.

Last year, SBI introduced YONO, which stands for “You Need Only One,” a single, integrated app. SBI’s various financial and lifestyle products are available through YONO. According to SBI, customers can open a savings account immediately by downloading the YONO app to an Android-based smartphone from the Google Play Store and doing so from the convenience of their own home.

Eligibility for Online SBI Account Opening in Zero Balance

To be eligible to Online SBI Account Opening in Zero Balance

, customers need to meet certain criteria:

- Should be a citizen of India.

- The individual should be 18 years and above to be eligible.

- In the case of minors, the parents or legal guardian of the minor can open the account on their behalf.

- The applicant is required to have valid identity and address proof that is Government approved.

- Following approval from the bank, the applicant will have to make an initial deposit – depending on the minimum balance requirement of that particular savings account he/she has chosen.

Documents Required to Online SBI Account Opening in Zero Balance

To be eligible for the SBI Savings Account, customers will have to submit the following documents along with account opening form:

| Proof of identity | Aadhar, Passport, Driving license, Voter’s ID card, etc. |

| Proof of address | Aadhar, Passport, Driving license, Voter’s ID card, etc. |

| Other important documents |

|

Types of Online SBI Account Opening in Zero Balance

The following are the various types of Online SBI Account Opening in Zero Balance

- Basic Savings Bank Deposit Account

- Basic Savings Bank Deposit Small Account

- Savings Bank Account

- Savings Account for Minors

- Savings Plus Account

- Insta Plus Savings Bank Account through Video KYC

- Motor Accidents Claim Account

- Resident Foreign Currency (Domestic) Account

Steps to Online SBI Account Opening in Zero Balance:

Follow the steps mentioned below to Online SBI Account Opening in Zero Balance –

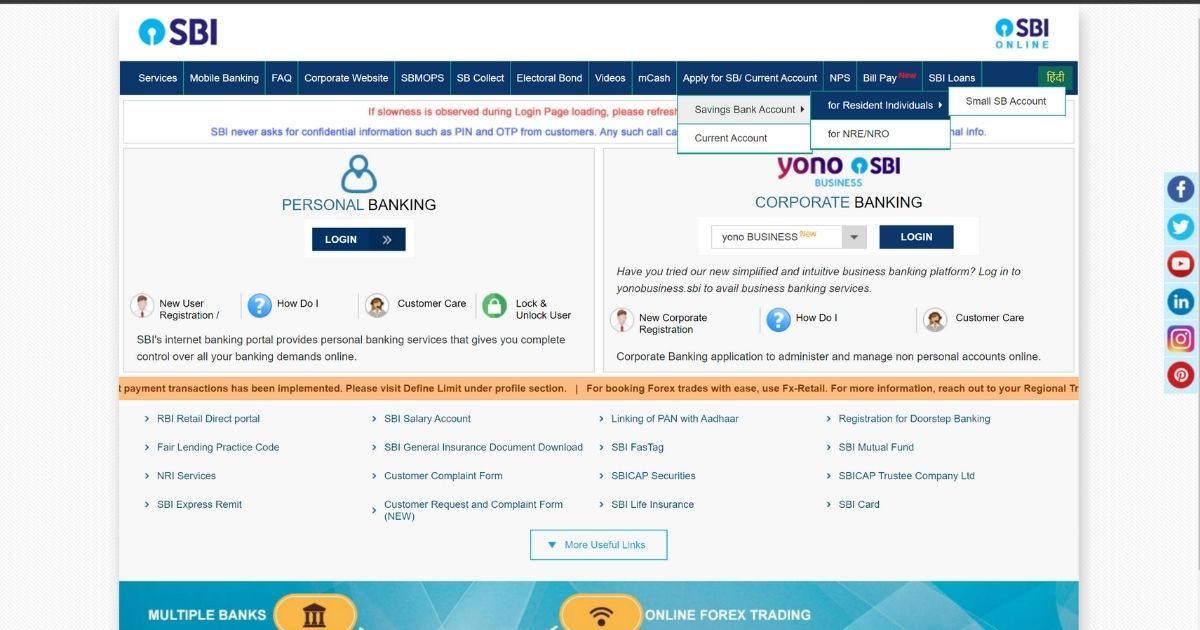

Step 1: Visit the State Bank of India homepage https://sbi.co.in/web/personal-banking/accounts/saving-account

Step 2: Click on “Apply Now”.

Step 3: Choose ” SBI Savings Accounts“.

Step 4: Fill in the application form – name, address, date of birth and other various details – and click on submit.

Step 5: Once the details have been submitted, the bank will intimate the applicant to visit the branch will the requisite KYC documents – proof of identity and address.

Step 6: On submission of the documents, the bank will initiate the verification process.

Step 7: Following approval, the account will be activated within 3-5 bank working days.

How to Online SBI Account Opening in Zero Balance through Video KYC?

To open SBI Insta Savings Account through video KYC, follow the steps mentioned below –

Step 1: Download the YONO App in your phone.

Step 2: Open the YONO App and select ‘New to SBI’ and then ‘Open a Savings Account.’

Step 3: next, select ‘Without Branch Visit’ option.

Step 4: You will be redirected to a new page where you have to enter your PAN and Aadhaar details.

Step 5: Next, enter the OTP which is sent to your Aadhaar registered mobile phone.

Step 6: After this, you will be asked to provide more details.

Step 7: After filling the details, you will be asked to schedule a video call.

Step 8: Complete the KYC process at the scheduled time to open your savings account.

Steps to Open a Savings Account in State Bank of India(SBI) Offline

To open a SBI savings account at any SBI Bank branch, customers will have to follow the steps mentioned below:

Step 1: Visit the SBI branch closest to you.

Step 2: Request the bank executive for an account opening form.

Step 3: On the account opening form, applicants will have to fill in both the parts.

- Form 1 – Name, address, signature, various other details and assets.

- Form 2 – Customers will have to fill in this part if they do not have a PAN card.

Step 4: Ensure that all the fields have been entered and are correct. The details mentioned in the application form should match those mentioned in the KYC documents that have been submitted.

Step 5: The customer will now have to make an initial deposit of Rs.1,000.

Step 6: As soon as the bank completes the verification process, the account holder will be granted a free passbook and cheque book.

Step 7: Simultaneously, customers can submit the internet banking form.

Online SBI Account Opening in Zero Balance! SBI Savings Account Helpline

For any help, grievance, or request related to SBI savings account, customers can contact the helpline at – (1800) 112 211

FAQs on Online SBI Account Opening in Zero Balance

- How many days does it take to open a savings account in SBI?It takes a total of three to five to get your SBI savings account activated.

- What is the minimum balance in SBI bank savings account?The Average Minimum Balance (AMB) of SBI savings account in metro, sei-urban, and rural areas are Rs.3000, Rs.2000, and Rs.1000, respectively.

- Can I keep my SBI account with zero balance?Yes, SBI offers their customers a zero-balance savings account which does not require them to keep a minimum balance.

- Is SBI savings account free?Yes, savings account can be opened in State Bank of India free of cost. No charges will be imposed on the accountholder.

- Should I open SBI savings accounts over phone, in case I get a call from the bank?No, never open an account or provide any vital document or financial details to anyone over the phone.

- Is it possible to have more than one SBI savings account?Yes, you can have more than one savings account with one customer ID and all the accounts would be interlinked.

- How can I check my SBI account balance?Send SMS to 09223766666 from the registered mobile number by typing ‘BAL’ to check your SBI savings account balance.

- Is Aadhaar mandatory to open an SBI savings account?No, as per the current guidelines issued by the bank, Aadhar card is not mandatory to open SBI savings account.